Introduction:

In an era where finance meets technology, Fintech software development companies stand as the architects of financial evolution. These innovative firms play a pivotal role in reshaping the landscape of financial services, providing tailored solutions that merge cutting-edge technology with the intricate demands of the financial sector. In this exploration, we delve into the realm of Fintech software development, examining the key players, trends, and the transformative impact they have on the global financial ecosystem.

The Rise of Fintech Software Development Companies:

Fintech, short for Financial Technology, represents the fusion of finance and technology to create solutions that redefine traditional banking, investing, and financial management. Fintech software development companies have emerged as the driving force behind this revolution. These companies leverage their expertise in software engineering, data analytics, and cybersecurity to deliver solutions that address the evolving needs of financial institutions, businesses, and consumers.

Key Services Offered by Fintech Software Development Companies:

Mobile Banking Applications:

Fintech software development companies excel in creating intuitive and secure mobile banking applications. These apps empower users with convenient access to their accounts, seamless fund transfers, and real-time financial insights.

Blockchain Integration:

As blockchain technology gains prominence, Fintech developers integrate decentralized ledgers into financial systems. This enhances security, transparency, and the efficiency of transactions, impacting everything from cross-border payments to smart contracts.

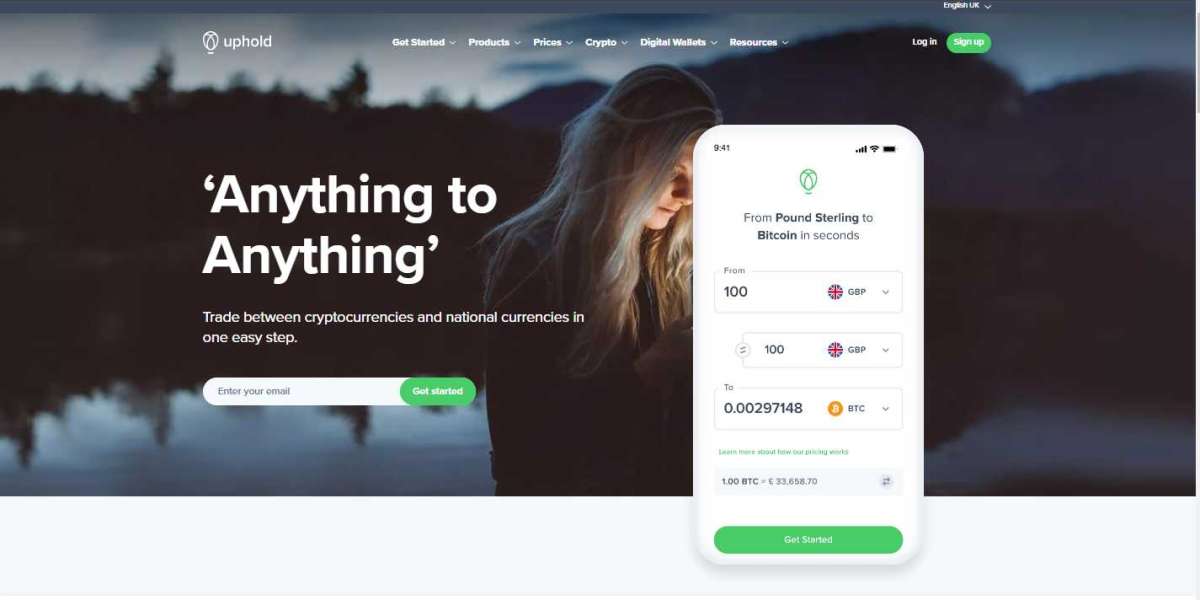

Digital Wallets:

The rise of digital wallets has transformed the way we handle money. Fintech software development companies craft secure and user-friendly digital wallet solutions, facilitating cashless transactions and providing a streamlined payment experience.

Data Analytics and Machine Learning:

Harnessing the power of big data, Fintech developers employ advanced analytics and machine learning algorithms to derive meaningful insights. This data-driven approach enables better risk management, fraud detection, and personalized financial recommendations.

RegTech Solutions:

Regulatory Technology (RegTech) is another area where Fintech software development companies shine. They create compliance management systems that help financial institutions navigate complex regulatory landscapes, ensuring adherence to evolving laws and standards.

Leading Fintech Software Development Companies:

Adyen:

Adyen is a global payment company that provides a seamless payment experience for businesses. Their Fintech software solutions cover online, in-store, and mobile payments, catering to the diverse needs of merchants worldwide.

ThoughtMachine:

Known for its core banking system, Vault, ThoughtMachine is revolutionizing the banking industry. Their Fintech solutions focus on flexibility and scalability, allowing banks to adapt to changing market demands efficiently.

Ripple:

Ripple is a frontrunner in blockchain-based solutions for cross-border payments. Leveraging its digital payment protocol, XRP, Ripple enables faster and more cost-effective international money transfers.

Ant Financial (Alipay):

As an affiliate of Alibaba Group, Ant Financial is a giant in the Fintech industry. Alipay, its digital payment platform, serves millions of users globally, emphasizing financial inclusion and technological innovation.

Plaid:

Plaid specializes in connecting financial applications to users' bank accounts. Their APIs enable seamless integration, providing a bridge between financial institutions and Fintech applications for enhanced user experiences.

Trends Shaping the Future of Fintech Software Development:

Open Banking:

The concept of open banking is gaining momentum, with Fintech developers creating APIs that allow third-party applications to access financial data. This fosters innovation, competition, and a more interconnected financial ecosystem.

Cryptocurrency and Decentralized Finance (DeFi):

Fintech software development companies are actively involved in the development of cryptocurrency platforms and DeFi solutions. This represents a paradigm shift in traditional finance, offering decentralized alternatives for lending, borrowing, and trading.

Artificial Intelligence (AI) in Fraud Detection:

AI is becoming integral to Fintech security strategies, particularly in fraud detection. Advanced machine learning algorithms analyze patterns and anomalies in real-time, enhancing the ability to identify and prevent fraudulent activities.

Robo-Advisors:

Fintech developers are creating robo-advisors that leverage AI and machine learning to provide automated, algorithm-driven financial planning services. This democratizes investment advice, making it more accessible to a broader audience.

Challenges and Opportunities in Fintech Software Development:

Security Concerns:

With the increasing reliance on digital financial solutions, security remains a top concern. Fintech software development companies must continuously innovate to stay ahead of cyber threats and ensure the integrity of financial transactions.

Regulatory Compliance:

The dynamic nature of the financial industry's regulatory landscape poses a challenge for Fintech developers. Striking a balance between innovation and compliance requires a nuanced understanding of global regulatory frameworks.

User Education:

Educating users about the benefits and risks of Fintech solutions is crucial. Fintech software development companies need to invest in user-friendly interfaces and comprehensive educational resources to build trust and adoption.

Conclusion:

As Fintech software development continues to evolve, these companies play a crucial role in shaping the future of finance. The intersection of technology and finance presents unprecedented opportunities for innovation, financial inclusion, and improved user experiences. The Fintech landscape will undoubtedly witness further advancements, with these companies at the forefront of creating solutions that redefine how we manage, invest, and transact in the digital age.